🗣 SL提问: ai etf股票

✍️ Ai批改: You're interested in AI ETFs!

AI ETFs, or Artificial Intelligence Exchange-Traded Funds, are investment funds that focus on companies involved in the development and application of artificial intelligence (AI) and machine learning (ML) technologies、Here are some popular AI ETFs:

List of AI ETFs:

1、iShares Robotics and Artificial Intelligence ETF (IRBO): Tracks the performance of companies involved in robotics and AI.

2、Global X Robotics & Artificial Intelligence ETF (BOTZ): Focuses on companies involved in robotics, AI, and automation.

3、ARK Innovation ETF (ARKK): Actively managed ETF that invests in companies involved in AI, robotics, and other disruptive technologies.

4、iShares PHLX Semiconductor ETF (SOXX): While not exclusively an AI ETF, it holds companies involved in semiconductor production, which is crucial for AI hardware.

5、VanEck Vectors Semiconductor ETF (SMH): Another semiconductor-focused ETF, which is relevant to AI hardware.

6、First Trust Indxx Innovative Transaction & Process ETF (LEGR): Tracks companies involved in innovative transactions and processes, including AI.

7、WisdomTree Artificial Intelligence and Innovation Fund (WTAI): Focuses on companies involved in AI research, development, and implementation.

Performance:

The performance of AI ETFs can be volatile, as the underlying companies and technologies are often in the early stages of development、However, some of these ETFs have shown strong growth in recent years.

Things to consider:

1、Expense ratios: AI ETFs often have higher expense ratios compared to traditional ETFs, as they invest in niche and emerging technologies.

2、Concentration risk: Some AI ETFs may have a high concentration of holdings in a few large companies, which can increase risk.

3、Technological advancements: The AI landscape is rapidly evolving, and ETFs may need to adapt to new technologies and trends.

Investing in AI ETFs:

Before investing in AI ETFs, consider:

1、Your investment goals: Are you looking for long-term growth or short-term gains?

2、Risk tolerance: AI investing can be volatile, so it's essential to assess your risk tolerance.

3、Diversification: Spread your investments across various asset classes and sectors to minimize risk.

Keep in mind that this is not a comprehensive list, and new AI ETFs may emerge as the industry evolves、Always research and evaluate the underlying holdings, expense ratios, and investment objectives before investing.

Would you like me to provide more information on a specific AI ETF or help you with your investment strategy?

0

IP地址: 117.1.168.73

搜索次数: 90

提问时间: 2025-04-21 15:39:37

❓️ 热门提问:

越南金子龙

2020年春节黄金价格

ai创作歌词

6个9黄金多少钱一克

山东邦尼黄金集团有限公司

山证资管中债1-3年国开债指数C

国际国际金价实时行情

如何辨别黄金是真是假

2025年2月14日金价回收价格

今日中金黄金价格

豌豆Ai站群搜索引擎系统

🤝 关于我们:

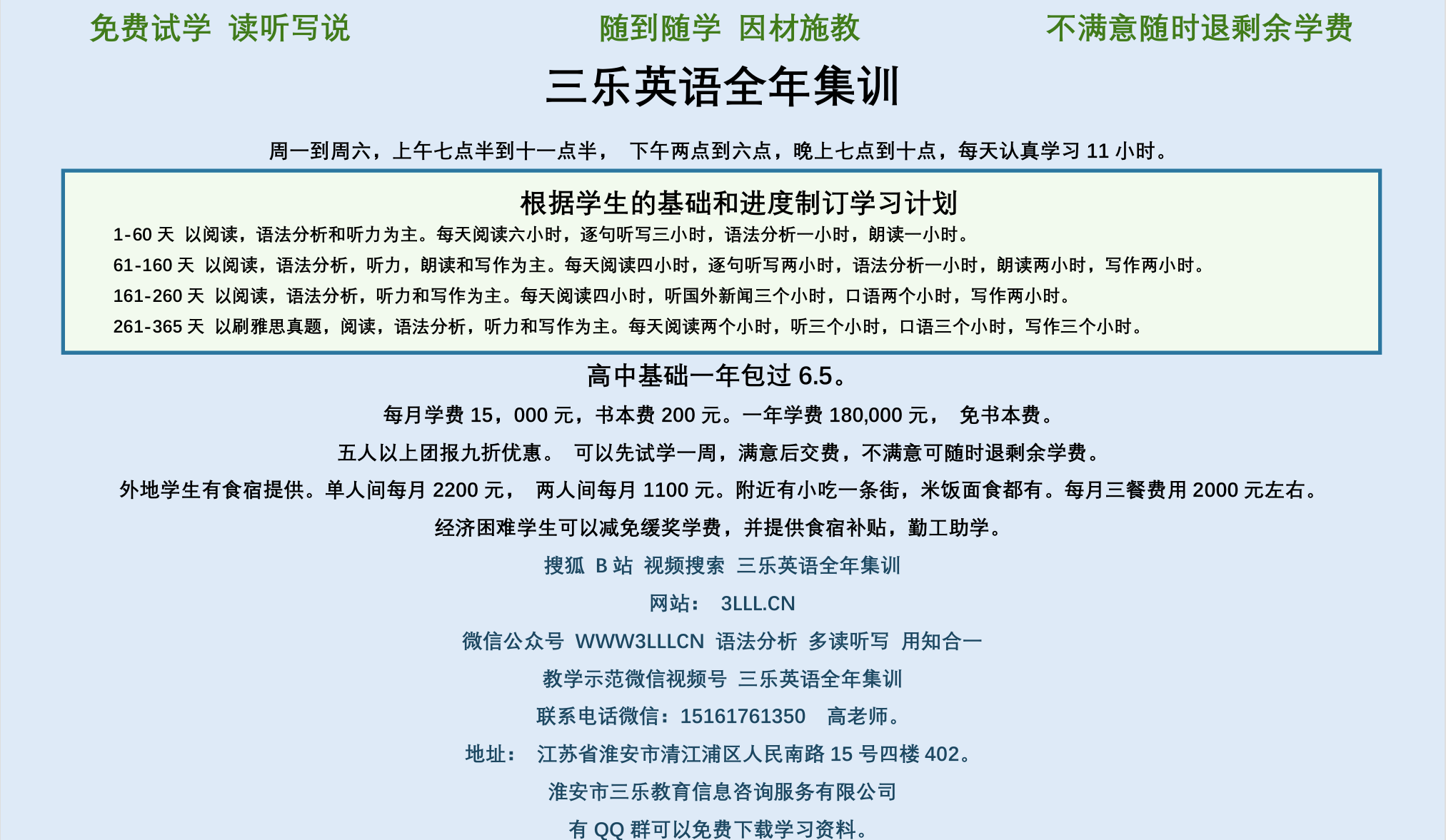

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。